We’re always encouraged when an Underground Bunker reader takes a deep dive into Scientology’s arcane depths, such as the time we were treated to a thorough examination of founder L. Ron Hubbard’s war record by a military veteran. This time, another reader has come forward with some eye-opening research on Scientology’s most secretive branch, the Church of Spiritual Technology, which operates vaults for storing Hubbard’s writings and lectures in order to last for thousands of years, and also the compound where we believe Shelly Miscavige is kept out of sight. We think you’re going to enjoy this thorough look at CST’s underlying facts. Today: CST’s corporate structure, and its numerous subsidiaries.

A Foundation of Secrecy

Whistleblowers have long pinpointed the Church of Spiritual Technology headquarters to be in a remote compound in Twin Peaks, CA, 80 miles east of Los Angeles.

However, records show that CST uses a pair of mailing addresses in Los Angeles for its business and property filings, sometimes interchangeably. The first address, 7051 Hollywood Blvd, Suite 100, Los Angeles, CA, actually houses the Scientology venture known as Author Services Inc. The second CST address is simply a mailbox at a strip mall in central Los Angeles. These addresses form a layer of secrecy around CST.

Records indicate that CST has approximately 20 personnel today, known to hail from Scientology’s Sea Organization. The CST corporate officers listed in California filings are Sara Reyes (CEO, formerly known as Sara Bellin), Jane McNairn (Secretary) and Arthur Bolstad (Treasurer).

CST’s Articles of Incorporation also require several trustees, who must be active Scientologists for at least eight years. All of these individuals serve at the pleasure of David Miscavige and reportedly have signed resignation letters filed away.

Meanwhile, Shelly Miscavige, once the number two official in Scientology hierarchy, is not listed on any documentation for CST. In fact, there are no records indicating she has any role, even within this small component of Scientology.

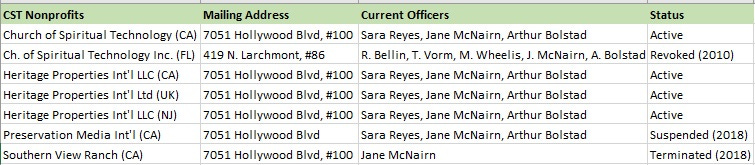

CST Non-profits

CST has set up six additional non-profits over its history, using the same mailing addresses and corporate officers as the Church of Spiritual Technology itself. These entities have also experienced their share of fines and suspensions. Several have been abandoned by CST entirely.

The Church of Spiritual Technology was first established in California in 1982. The Church of Spiritual Technology, Inc. was established as a charitable organization in Florida in July 1997, sharing the same tax-exempt identification number as the original CST. This Florida nonprofit was later revoked in September 2010 by state officials for its failure to file records.

Heritage Properties, LLC was set up in March 2003, and its subordinate counterparts in the United Kingdom and New Jersey were set up in more recent years. This group of nonprofits reveal CST’s more recent focus, the “Heritage Project,” responsible for purchasing and refurbishing several of L Ron Hubbard’s former homes. The UK component, Heritage Properties, Ltd., is likely part of its elaborate legal scheme to avoid paying taxes to the United Kingdom, since Scientology was denied charity status in that country.

Preservation Media International and Southern View Ranch were set up as CST non-profits in California in 2011 and 2016, respectively. However, records indicate the IRS did not endorse these as nonprofits and never issued them tax-exempt identification numbers. Each were subsequently either abandoned by CST officials or closed by California for lack of supporting documentation in 2018.

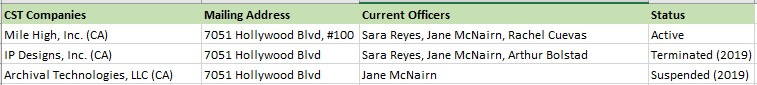

CST’s Businesses

In an unusual set of moves, CST has also created at least three for-profit businesses using its tried and true mailing addresses and corporate officers.

Mile High, Inc. is a California company established in September 1985, and long reported on Wikipedia and other outlets as a CST company. This company sometimes does business as “M H Inc.”

Records indicate it was originally set up as a property holding company prior to CST gaining tax-exempt status in 1993. Today, its use is primarily an attempt to mask the identity of CST and its headquarters in Twin Peaks, CA. While it lists a separate Sea Org member as its Treasurer, its other officers, address and even registered agent all follow the CST pattern.

In more recent years, IP Designs, Inc. and Archival Technologies, LLC were established by CST management as California companies in 2008 and 2014, respectively. Document searches indicate these two entities are shell companies with no known physical property or employees. It is unclear if either company held intellectual property or portions of CST’s vast wealth. Again, these companies mimic the officers and addresses of CST itself.

These companies have all repeatedly run afoul of California’s state filing requirements and have been fined or even suspended by the California’s Tax Franchise Board during their histories. In fact, CST executives sometimes appear to struggle keeping their stories straight and maintaining the up-to-date filings required to operate.

IP Designs, Inc. was closed by CST in 2019 following four delinquency penalties and two periods of suspension.

Meanwhile in 2021, CST’s Secretary Jane McNairn attempted to reinstate Archival Technologies, LLC by filing a standard form with California officials, even though the company was actually suspended for missing its tax filings. In the process, McNairn listed her CST email address on the form. This company remains suspended from conducting business in California today for its lack of financial filings.

No doubt, such lapses occur in part from CST’s own insistence on extreme secrecy by operating with “cut-out” mailing addresses, rather than allowing mail and notifications be sent directly CST Headquarters in Twin Peaks, CA.

A concentration of entities using the same address and personnel is considered a red flag in many financial oversight investigations around the world. In fact, the US Treasury Department’s own Financial Crimes Enforcement Network has advised banks to more thoroughly review the financial transactions of companies when they share similar characteristics, such as the same address, registered agent or have other address inconsistencies.

Finding a group of companies and nonprofits that share the same characteristics is even more unusual. While legal to establish, as a group, their ongoing operations bring up many questions of self-dealing, proper accountability and oversight. US taxpayers, and even Scientologists donating to these causes, deserve that oversight.

Next time: We explore the Church of Spiritual Technology’s property holdings across the US today.

Want to help?

You can support the Underground Bunker with a Paypal contribution to bunkerfund@tonyortega.org, an account administered by the Bunker’s attorney, Scott Pilutik. And by request, this is our Venmo link, and for Zelle, please use (tonyo94 AT gmail).

Thank you for reading today’s story here at Substack. For the full picture of what’s happening today in the world of Scientology, please join the conversation at tonyortega.org, where we’ve been reporting daily on David Miscavige’s cabal since 2012. There you’ll find additional stories, and our popular regular daily features:

Source Code: Actual things founder L. Ron Hubbard said on this date in history

Avast, Ye Mateys: Snapshots from Scientology’s years at sea

Overheard in the Freezone: Indie Hubbardism, one thought at a time

Past is Prologue: From this week in history at alt.religion.scientology

Random Howdy: Your daily dose of the Captain

Here’s the link to today’s post at tonyortega.org

And whatever you do, subscribe to this Substack so you get our breaking stories and daily features right to your email inbox every morning.

Paid subscribers get access to two special podcast series every week…

Up the Bridge: A weekly journey through Scientology’s actual “technology”

Group Therapy: Our round table of rowdy regulars on the week’s news

Well done and well written volunteer correspondent. Shell companies and other 'where can we hid the money corporations' are a pox on the body politic and need to be reined in. Good luck with that, too many very rich people own or rent enough laws and judges to keep that water black.

What is it with the CO$ inability to obey simple accounting procedures? Why apply for a certain tax status and then fail to obey its strictures? I am guessing that some overlord didn't read the not so fine print and would not let the financial dogs out. VC (volunteer correspondent) gets that perfectly.

Miscavige made a huge deal out of preserving Hubbard “Standard Drech”. And I know millionaire donors who donated huge sums to buy titanium plates of Scientology’s important bulletins. And I remember Craig Jensen showing me the special titanium storage safe he bought “just like the ones they used to store LRH materials.” He was so proud. Only cost him, $150,000.

This is the ultimate in elitism. Just another way little Davey scammed us to add to his his billions.